Should You Invest in Hasbro?

OVERVIEW

Hasbro Incorporation is a company based in the United States. The company designs, manufactures, and distributes toys and games around the world. Some of the things that they are responsible for producing are toe toy lines of Star Wars, My Little Pony, Monopoly, and many others. The company distributes them to wholesalers, brick and mortar stores, as well as e-commerce platforms. The company was founded in 1923.

Why You Should?

- The COVID-19 Pandemic has boosted the sales of toys and board games around the world as families stay at home. Playing a Hasbro board game, or a mobile game is a great way to spend time with family at home. Consumers are also giving Hasbro toys to children in order to keep them entertained during this time of online schooling and limited gatherings.

- Hasbro has a strong brand portfolio with some nostalgic names for millions of consumers. These strong brands will help the company drive sales for their products as consumers will buy their well-known products over others. This will help the company grow and will also benefit investors in this company.

- Hasbro reports some of its strongest financial results during holiday quarters, something that is upcoming. Hasbro is projecting a strong holiday quarter as consumers purchase gifts and toys online instead of going in-person to shop. A strong holiday quarter will benefit both the company and its investors.

- Not only does Hasbro make board games and toys, but they also design and distribute several video games. This digital footprint will benefit the company to adapt to changing consumer preferences on how they want to spend their free time.

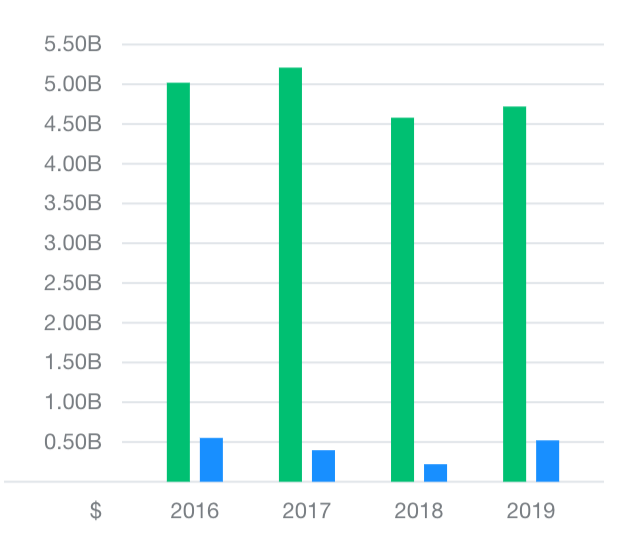

- The company has seen rising revenues and profits over the past couple of financial years and looks for these strong results to continue. This will help the company expand its presence in the toy industry and will also benefit investors in the company. In the financial year of 2019, the company reported revenues of around 4.72 billion and profits of around 520.45 million. Both of these metrics are higher than what the company reported in the financial year of 2018 when they reported revenues of around 4.58 billion and profits of around 220.4 million.

Why You Should Not?

- Hasbro has faced tough competition from companies like Mattel (the maker of Barbie and Hot Wheels), LEGO, and many others. This tough competition along with children playing more video games from a younger age might also hurt the company’s market share in the toy industry.

- Hasbro had a tumultuous 2018 as Toys-R-Us, one of the leading retailers of toys, filed for bankruptcy. This caused a sharp decline in volumes for the company’s toy and board game lines. Though the company has seen sales rebound after 2018, it has still not reached levels before. The company’s weak e-commerce footprint has hurt it in the past and might continue to hurt them in the future.

MY OPINION

In my opinion, I think that Hasbro is a decent long-term investment due to stable sales through the COVID-19 Pandemic, its portfolio of strong brands, an upcoming holiday season, a good digital footprint, and rising revenues and profits. However, competition as well as a weak e-commerce footprint might hurt the company in the future.